Friends,

As we approach the end of an eventful 2018, there continues to be a steady torrent of major news stories dropping daily. From CEOs tweeting about taking their companies private, to escalating global trade wars, to bitter battles on Capitol Hill, the financial markets have had a lot to digest. Though the news can seem overwhelming at times, we believe investors should remain focused on the issues that matter for their investment portfolios: valuations, interest rates, economic conditions, and global trade. Each of these factors are at levels that indicate a richly valued stock market in the final stages of a historically long expansion with potential for major risk ahead. Let’s walk through each of them one-by-one.

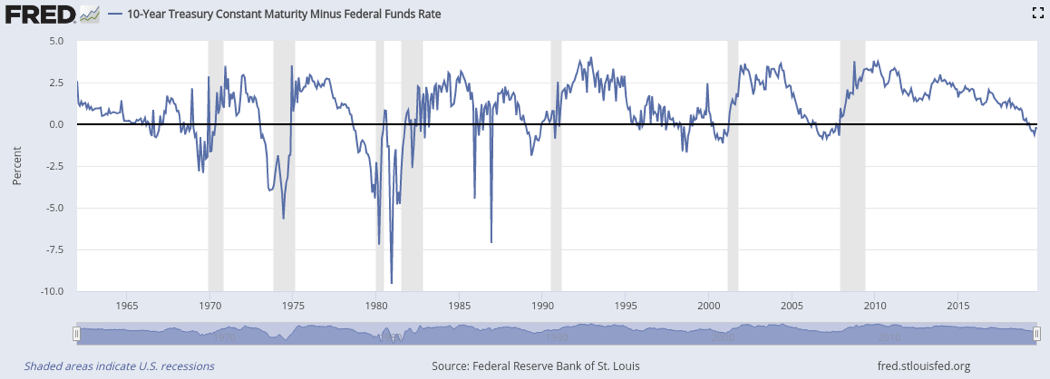

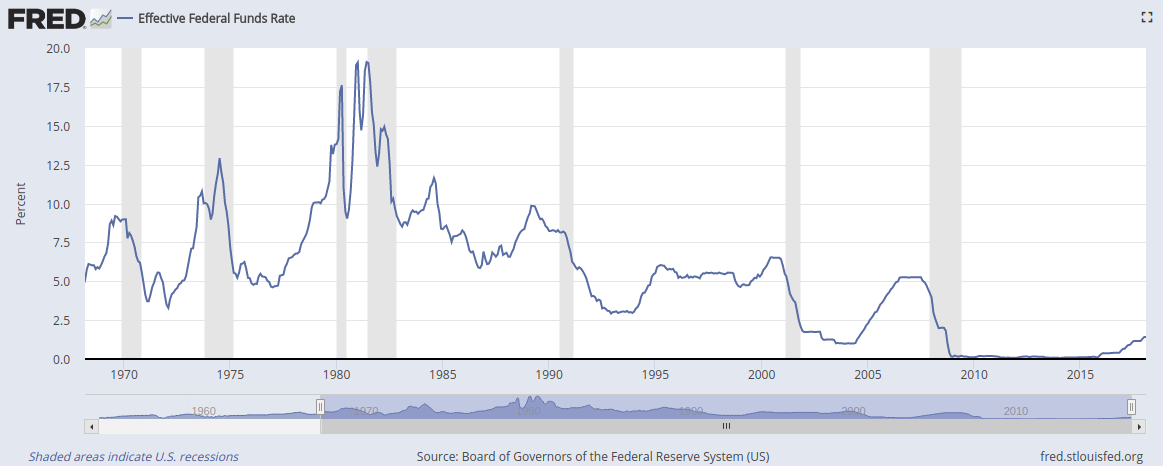

Interest Rates. As expected, the Federal Reserve raised interest rates in the third quarter and the Fed Funds rate now stands at 2.25%. The 10 Yr Treasury rate is almost at 3.25%, which is the highest it’s been since 2010. It’s likely the Fed will raise rates again by 0.25% in December and continue to raise rates at a similar pace (quarterly) in 2019. While rates remain on the lower end historically, rising rates will continue to take a chunk out of corporate profits as companies raising funds for projects in the debt markets are now paying higher rates than they have in years. The tax cut passed by Congress last year has provided a bit of a tailwind for corporate profits, but this boon will likely be offset by the costs associated with higher interest rates, especially for sectors that depend on high levels of debt.

Global Trade. Despite a major change in trade policy (tariffs), trade levels remain high. That said, there are several looming disputes (US-China, US-Europe) that may cause continued dislocation. We are beginning to see American companies modify their supply chains in response to tariffs. Though, in the long run, this will lead to the growth of manufacturing in new markets and new sources for intermediate and finished goods, in the shorter run this is likely to lead to some dislocation. History shows us that tariffs are almost always a net negative on economic output (as open trade is closed off) and we see no reason why the current tariff war will result in anything other than economic slowdown. If the results of the “new NAFTA” is any indication, the tariff wars will not bring increased economic prosperity to the US, but rather, hurt industries dependent on foreign trade while damaging relations with our trade partners/allies and eroding their trust.

Valuations. Stock valuations remain at cyclical highs. The S&P 500 is trading at 25 times historical earnings, which is about 50% higher than the historic average. When we look at cyclically adjusted measures of earnings, these are at even higher levels. Yale professor Robert Shiller’s Cyclically Adjusted PE ratio (which uses the past ten years of earnings as a denominator to account for the business cycle) is currently over 33. The only other time it has been higher than 30 was in 1929, on the eve of the great depression, and in 1999-2001 during the tech boom. This measure has been above 30 for most of 2017 and 2018. Can this continue? It certainly can, but if we use history as a guide, economic expansion can end quickly, rendering current valuations as especially lofty in hindsight.

Economic Conditions. Despite the concerns mentioned above, economic conditions in the US continue to be quite strong, with consumer confidence levels high and the unemployment rate low. Inflation is relatively tame and average hourly wages are finally rising. However, debt levels — corporate, government and consumer — are all at precariously high levels. If interest rates rise, trade wars persist and valuations remain elevated, we could see these conditions deteriorate.

In addition to these factors, there is a potential major market-moving event on the horizon: the mid-term elections on November 6th. Mid-term elections tend to be a referendum on the White House and ruling party in Congress. Given the president’s low approval ratings, we believe Democrats are likely to re-take the House. We think they have an outside chance at winning back the Senate. This is far less likely because there are fewer Republican seats up for election, and because small, low-population inland states get as many senators as large coastal ones. We think a House controlled by Democrats will lead to meaningful investigations of political corruption in the Trump administration. All indicators suggest this is a target-rich environment for such investigations. If the White House decides to work with Democrats, as they indicated they might in 2017, we could see a curtailment of tariffs and a wide-ranging infrastructure bill. Given the highly partisan political environment, however, compromise seems less likely and gridlock the norm.

How will markets respond? It’s difficult to predict, but if we see a Democrat controlled house, the Congressional agenda of the past two years (deregulation, protectionist trade policy, tax breaks and loosening of environmental regulations) will likely end. Investors in sectors like conventional energy and materials/mining will see this as a negative. Sectors like renewable energy and industries dependent on trade, like technology, are likely to view it as a positive development.

We continue to recommend balanced investment portfolios and a reduction of exposure to risk assets that may be vulnerable in a market correction.

Regards,

Subir Grewal, CFA, CFP Louis Berger