Investment Management

Do you ever wonder whether your savings will allow you to live life on your own terms?

Our clients don’t have to wonder. We start off by identifying a saving and investment strategy that you can stick with for the long term. We then construct a portfolio that seeks to limit losses and provide reliable growth or income.

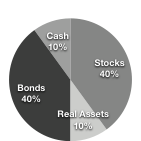

To meet that goal, we construct recommend diversified portfolios which include allocations to stocks, bonds and some commodities or alternatives. We’ll develop a long-term strategic allocation based on your objectives, but we will also make short-term, tactical modifications when market conditions warrant. Since we look for opportunities in all investment classes, we have adopted an open-architecture approach that allows us to invest across the globe, using investment solutions from from different brokers.

We seek to provide truly independent advice, recommending only those investments that are most appropriate for you. We recognize that our business succeeds only when our client’s interests come first. We are compensated based on annualized fees rather than sales commissions to align our incentives with those of our clients.

Investment Philosophy

Value Methodology

The investment process for us starts with a detailed analysis of the security or asset we are considering for purchase. We have a strong preference for investments in high-quality, financially-secure issuers. We seek to acquire investments at attractive values, (i.e. getting more for less). We apply this value methodology to stocks, bonds and any other asset we consider for purchase. In our experience, market prices oscillate widely around fair valuation (or worth), but eventually revert to the mean when euphoria and despair give way to more moderate emotion, or when demographic and structural changes have settled. What stays constant is that investors who purchase assets at bargain prices and keep their wits about them during the market’s periodic manias tend to do well. We invest in a wide variety of assets, but our focus is on US municipal and corporate bonds, US and Emerging Market stocks.

Risk Control and Outlier Scenarios

Risk Control and Outlier Scenarios

It is our belief that every investment carries some measure of risk. We consider it our highest responsibility to control risks that may impact a client’s plans. Before investing we discuss objectives and risks clearly with clients. The risk of an specific investment or an strategic allocation can vary over time. If general business conditions change or prices rise sharply, an otherwise sound investment can become risky and we may need to act to protect capital. We invest only when we have a firm understanding of an investment and can monitor its risk. We have a strong preference for investing at a time when the acquisition cost is below our estimate of value or worth so that we have a cushion for the unexpected or the overlooked.

When we evaluate risk, we look at outlier scenarios and seek to understand the underlying reasons for historical performance. For instance, unlike many other investors, we do not believe bonds are safer than stocks because historically they have had lower volatility. Rather, we recognize that bondholders are higher in the capital structure and have a prior claim to a company’s assets. Similarly, bond covenants, bankruptcy law and general market conventions have changed, and this makes comparisons between the early or mid-century performance of bonds with current bonds less reliable. When we first evaluate a stock or bond, we like to consider scenarios under which it would be worthless, not because we are morbid, but because we wish to understand its risk better.

A word on index funds

We believe index funds or ETFs can be an attractive investment vehicle for investors, and we use them for several different markets.

It’s important however, for investors to understand two factors that impact indices:

- Standard indices do not incorporate valuations and the committees responsible for constructing indices do not add or drop components based on their value, risk or return potential. Market cap indices (like the S&P 500) in particular, are driven by market prices. The popularity of indexing among investors has led to larger pools of capital that are “blind” to the value of securities.

- Markets are not accurate measures of value at all times. That markets are prone to successive phases of euphoria and despair is clearly apparent to anyone who looks at the long-term history of asset prices in markets across the world.

As long as investors understand and appreciate these two factors, we believe index funds are a very useful tool. These two factors also create opportunity for those who are willing to do the work of security selection rather than delegate it to a committee or formula at S&P or MSCI. In most cases, our client portfolios include index funds and securities or funds that are chosen by applying our value methodology.

Balanced Portfolios

We have a healthy respect for the unpredictability of human affairs, the capricious nature of financial markets and our own limitations. To control the impact of these uncertainties on our client’s lives and finances, we favor balanced portfolios. Virtually all the portfolios we manage are balanced across several asset classes and will include investments with lower-risk. We will, upon request, advise on portfolios solely comprised of high-quality fixed-income (bonds and select dividend paying stocks).

We employ a value methodology to individual securities and correspondingly we evaluate the return potential and risks of individual asset-classes, adjusting levels in portfolios when we believe return potential will be low or risks are elevated.

Global Reach

Our investment professionals enjoy the benefit of wide-ranging experience and are curious about the world. We employ this experience to invest across the globe and in many different classes of investments. We may employ other portfolio managers in some instances since our resources are finite and we believe there is a benefit to diversifying across different investment strategies.

We seek to provide our customized, dedicated services to our clients at a reasonable cost, commensurate with its value.

Socially Responsible Investing

A number of our clients seek to have their investments incorporate their values. Whether your focus is on environmental causes, fair trade practices or corporate governance, we can work with you to include these factors in the investment process. We can employ a strategy that uses screens (avoiding or focusing on certain types of business activity) or one focused on shareholder advocacy (actively engaging with management to modify practices). Visit our SRI page to learn more.

Our service model

Constructing an individualized investment portfolio is only the first step in our commitment to our clients. Since our clients’ lives, objectives, and the financial markets are constantly evolving, ongoing communication and reassessment is essential to success. Our services include:

- An annual, comprehensive review of your portfolio and financial plan to ensure it continues to meet your financial objectives.

- Quarterly reviews of your portfolio’s performance with a focus on how your investments relate to the broader business and economic environment.

- Ongoing portfolio monitoring and updates whenever we see an investment opportunity or a need to adjust your portfolio.

Fee Schedule

Our fees are reasonable and commensurate with the services we provide. For our complete investment advisory or financial consulting agreements, please write or call us. Our financial consulting fee is determined by the volume and type of work we do for you. A comprehensive financial plan for a family generally costs $2,500. Our investment advisory fee schedule is below.

Household Assets Under Management

Up to $100,000

$100,001 to $500,000

$500,001 to $5,000,000

Over $5,000,000

Annual Advisory Fee

1.50%

1.25%

1.00%

By Negotiation

For disclosure information on our advisory services, please review our ADV brochure and ADV part 3.

Further Reading

For prospective clients curious about our investment process or keen to learn more, we’ve put together a list of books and resources we consider major influences.

- Irrational Exuberance – Robert J. Shiller

- The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel – Benjamin Graham

- Reminiscences of a Stock Operator – Edwin Lefevre

- Lombard Street: A Description of the Money Market – Walter Bagehot

- The Misbehavior of Markets: A Fractal View of Financial Turbulence – Benoit Mandelbrot

- Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment – David Swensen

- Fooled By Randomness: The Hidden Role of Chance in Life and in the Markets – Nassim Nicholas Taleb

- Manias, Panics, and Crashes: A History of Financial Crises – Charles P. Kindleberger

- Can it Happen Again? – Hyman P. Minsky