The Pandemic’s Impact on the Global Economy

Dear friends,

We hope this spring has brought you and your families a welcome respite from what was a hard, and isolating winter for many.

As we look forward to the course of this year, most observers are cautiously optimistic that the impact of the COVID-19 pandemic will steadily fade. As the pace of vaccinations has picked up in the US, so have expectations about an economic recovery. The impact of the additional stimulus bill passed by the new Congress has further driven optimism about the prospects for the US economy. Most equities analysts have chosen to write 2020 off as an outlier. Larger, public companies in many industries have managed to get through the past year largely unscathed, mainly due to the various fiscal and monetary measures put in place to aid them.

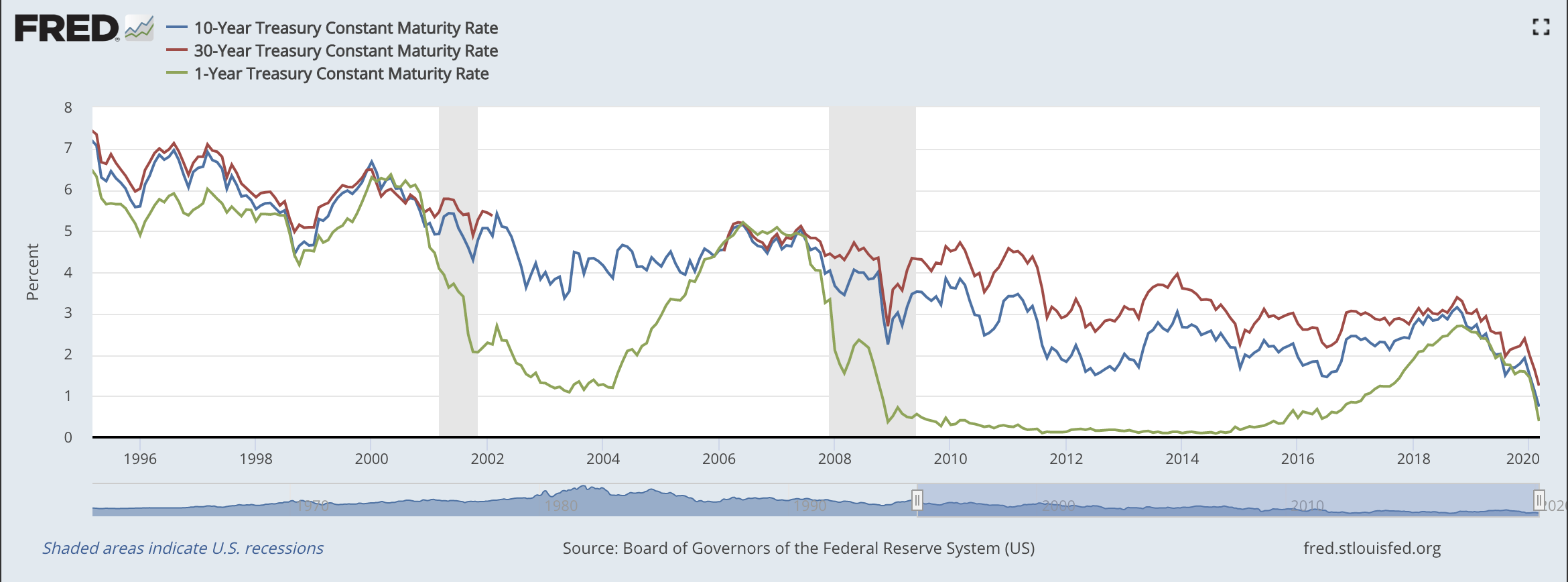

It appears as if the monetary stimulus in particular will remain in place for longer than some market observers view as necessary. Senior Federal Reserve officials have indicated the Fed has no plans to raise interest rates or amend its asset purchase program until 2024. This means bond investors can likely expect two+ years of stable, low short term rates. However, yields on intermediate and long term bonds have steadily crept up in 2021 driven by two factors: the recent sharp rise in commodity prices and the $1.9 trillion stimulus bill passed in March (with trillions potentially more on the way via an infrastructure bill). The rise in commodity prices signal higher inflation which some market participants think will cause the Fed to respond with an interest rate rise sooner than expected. The stimulus bill requires enormous amounts of treasury issuance to pay for it, and this influx of supply is causing longer term rates to rise. While this may end up being transitory and bond yields could settle back down, there is a chance that the Fed has not properly anticipated the possibility of a sharp rise in inflation and the glut of treasury supply may compound the issue for bond investors. Even with the recent rise on the mid/long end of the curve, bond yields remain low and we expect these lower yields and the possible risk of yields climbing higher from here to drive more bond investors into equities.

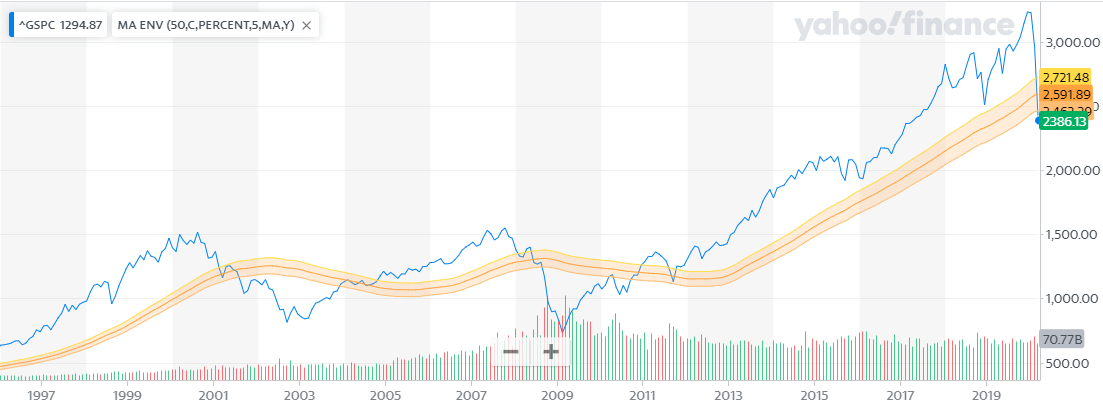

While equities may look attractive to bond investors smarting from rising yields, it has become an increasingly crowded trade. According to data compiled by Bank of America, more money has been invested in equity funds over the past five months than the previous 12 years combined. In dollar terms, that’s $569 billion flowing into global stock funds since November 2020 compared to $452 billion invested over the entirety of the 2009-2020 bull market. This kind of investment behavior is what markets tend to exhibit during manias as investors rush in to buy at any price. Though there are reasons to be optimistic about the potential for economic recovery, we believe the outlook for equities is far less certain. Equity investors today face prices that are at multi-decade highs, the prospect of higher corporate tax rates, an uncertain global vaccine rollout, and the possibility that a resurgence of the pandemic impacts critical sectors again.

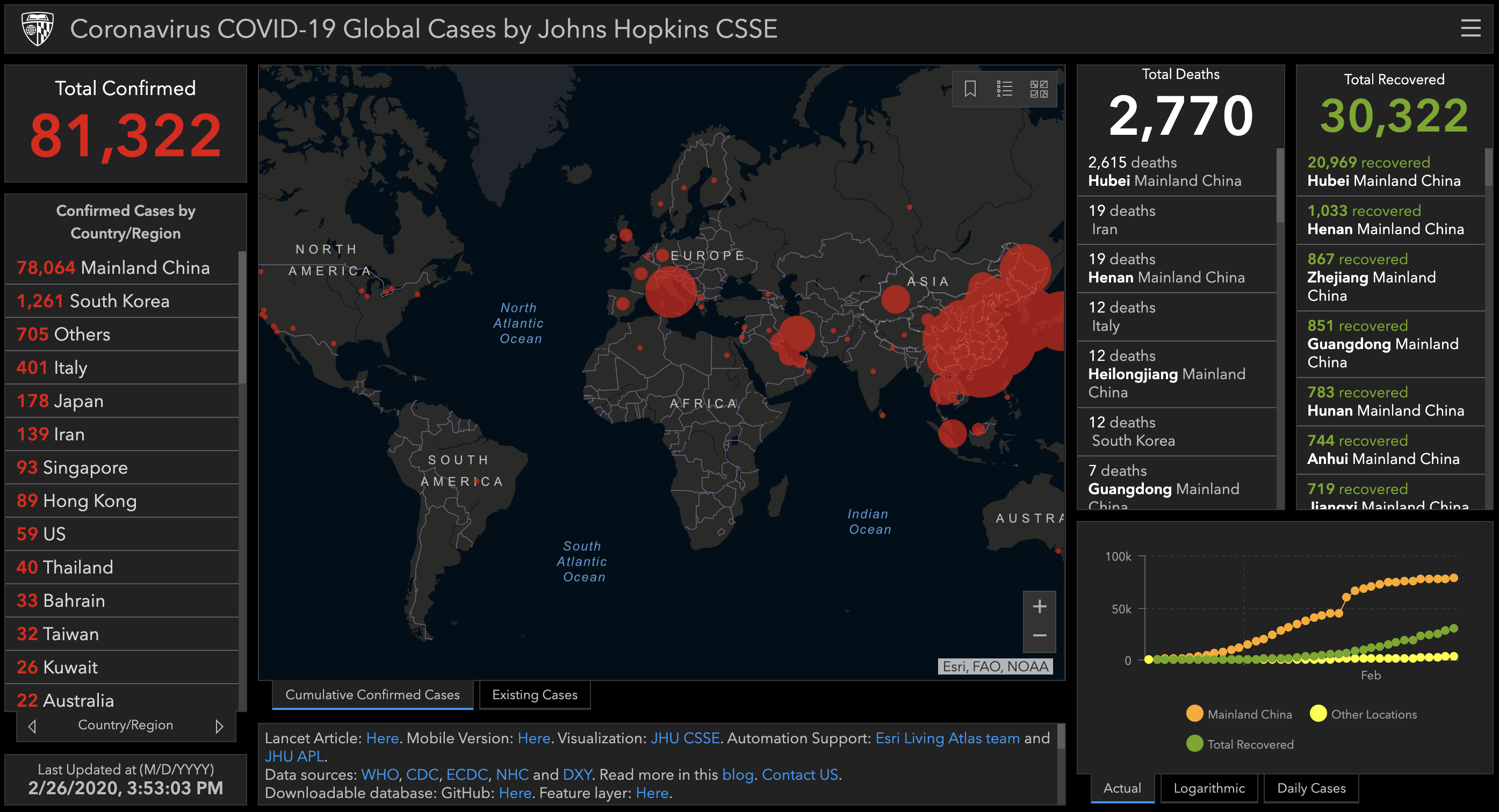

The prevailing sentiment in the US is that the worst impact of the pandemic is behind us. That is not true for much of the rest of the world, however. COVID-19 cases continue to rise

in several countries and public health officials have responded by instituting closures to contain the spread. International travel remains uncommon and arduous in most parts of the world. The global economy continues to be susceptible to risks related to the pandemic. As stock markets globally are at or near all-time highs, equity risks are compounded by very high valuations. Historically low interest rates and the inflation outlook create similar conditions in bond markets.

With short and medium term market conditions so uncertain in both bond and stock markets, we advise investors to maintain defensive allocations. While risk assets may continue to rally on the back of continued easy monetary policies, valuations look stretched and risk/reward does not appear to be favorable. We still see some pockets of opportunity in value stocks, emerging markets and precious metals/commodities, but the pickings are increasingly slim. If sentiment shifts, we’d expect risk assets to pull back sharply, presenting better investment opportunities.

Best,

Louis and Subir

PS — We’ve moved! Our new office is located in the financial district: 222 Broadway, 19th Floor, New York, NY 10038. Attached is a notice about our address change, our annual privacy policy notice and our Q1 invoice.

The foregoing contents reflect the opinions of Washington Square Capital Management and are subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or constructed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.