Market update: Measures to stall Coronavirus’ spread begin to impact global economic activity

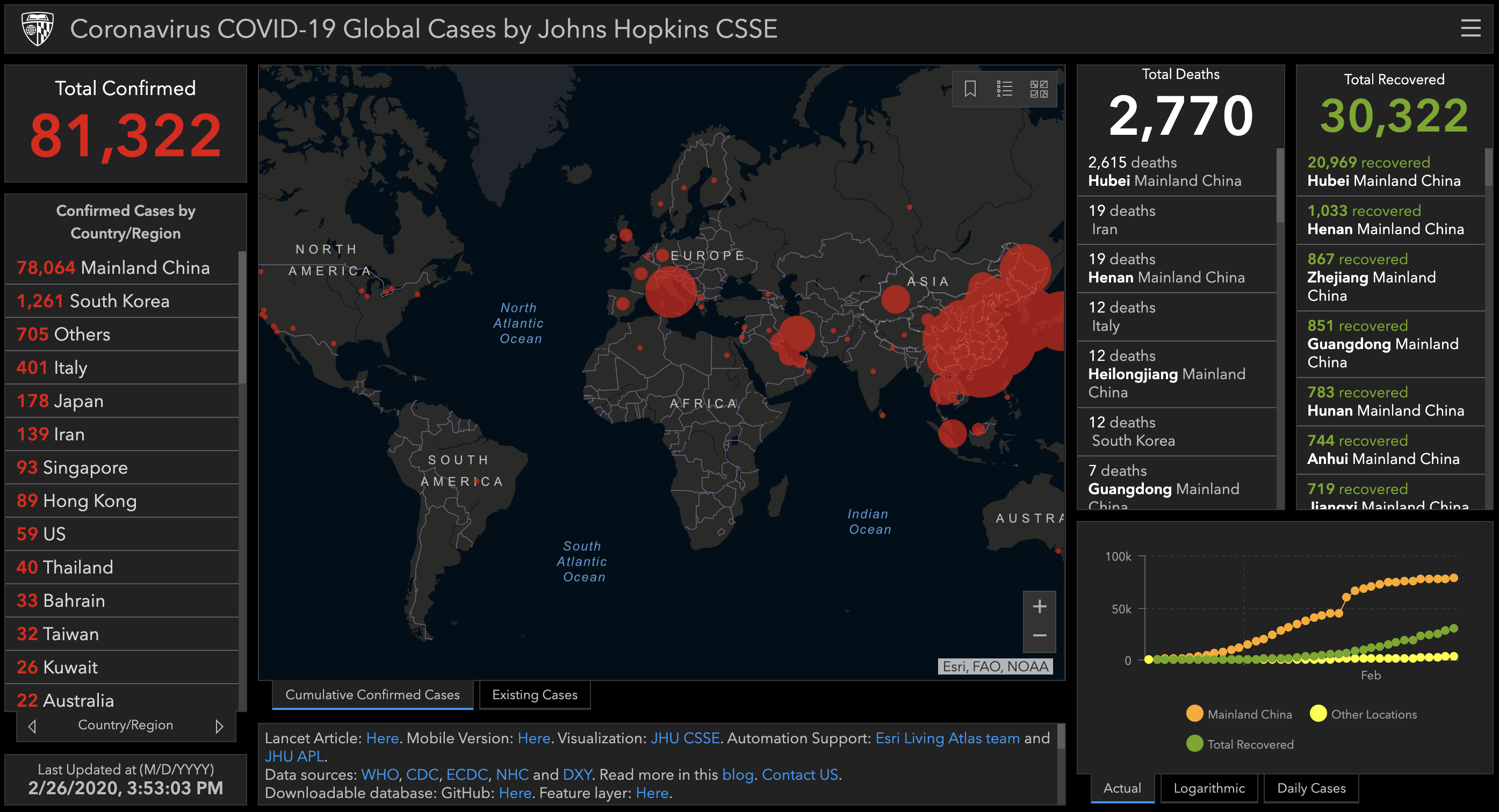

This week has seen two precipitous declines in US stock markets. The volatility has been attributed to fears of the Coronavirus strain named COVID-19. This infectious disease has now spread to several countries and caused over 2700 deaths. The reports of confirmed cases have almost certainly been under-counted as numerous developing countries with weaker health systems lack the resources to identify and respond to such outbreaks. To keep things in context, the annual flu causes more deaths in the US alone.

The market drop on Monday was driven by fears about the impact of COVID-19 on global trade. On Tuesday, federal officials warned that COVID-19 would almost certainly spread in the United States. They indicated that health professionals, hospitals, communities, businesses and schools should begin making preparations. This would include “social distancing measures,” like smaller groups in classes, canceling meetings or conferences and making arrangements to work from home. Dr. Nancy Messonnier, director of the National Center for Immunization and Respiratory Diseases, said in a news briefing that “it’s not so much of a question of if this will happen anymore but rather more of a question of exactly when this will happen.”

While we can’t speculate about the disease itself, or its spread, as this is far outside our area of expertise (we would urge readers to follow guidance from public health and safety officials), what we can do is evaluate the economic impact of the CDC’s recommended containment measures. We know that measures taken in China to prevent the spread of COVID-19 have been very disruptive. Most commercial flights within China have been cancelled. Almost all international airlines have suspended flights into and out of China. Supply chains for numerous industries have been reduced to a standstill and economic activity measured by power has slowed markedly. Oil demand in China has fallen 20%. In Europe, sports events have been cancelled, the hospitality industry in affected areas has seen cancellations and schools have sent students who recently visited northern Italy home. A major bank issued a warning that Switzerland may enter a recession due to the COVID-19 outbreak.

If the measures discussed by the CDC were to be implemented in the US, there would be a significant impact on economic activity and by extension corporate earnings. Millions of Americans can telecommute to work and it is reasonable to expect they could continue to work through such a potential crisis. However, a large segment of the US manufacturing and service sectors would be hobbled. This includes most entertainment, food service, travel, manufacturing and retail. It is difficult to estimate the precise impact on earnings, but the fact that we were recently at all-time highs and at the end of a maturing business cycle suggests any drop in expected earnings would have a significant impact on markets.

We are also concerned about the current administration’s preparedness for such a crisis. In 2018, part of the pandemic response infrastructure put in place after the Ebola outbreak was dismantled, without an adequate replacement put in place. This gap may lead to less than optimal coordination between federal agencies. The current crisis also reminds us of Michael Lewis’ 2018 book, The Fifth Risk. Lewis interviewed senior staff and ex-staff across numerous government agencies after the current administration took office amid reports of a haphazard transition with qualified personnel were leaving without being replaced. One of Lewis’ observations is that the Federal government is partly in the business of risk management. It evaluates and contains risks that are too big for any other US organization to handle. Funding cuts and the loss of experienced personnel severely undermines this mission.

Our healthcare system also has idiosyncratic vulnerabilities when dealing with such public health crises. Unlike other developed countries, most Americans face out of pocket expenses for healthcare. There are reports that individuals asking to be tested for COVID-19 received large medical bills. We know that the fear of unexpected bills often prevents people in the US from seeking timely care, necessitating expensive, late-stage interventions. The lack of timely diagnosis and treatment could exacerbate the spread of COVID-19 and have widespread public health impacts.

Even prior to the COVID-19 outbreak, we believed high equity valuations merited caution. Containment measures in China have already begun to impact the global economy, we expect the rising number of cases in Europe will have similar effects. If containment measures are required in the US, they are likely to have a significant impact on corporate earnings.

We reiterate our recommendation that investors maintain a defensive position in equities and other risk assets. We recommend caution as this situation continues to develop.

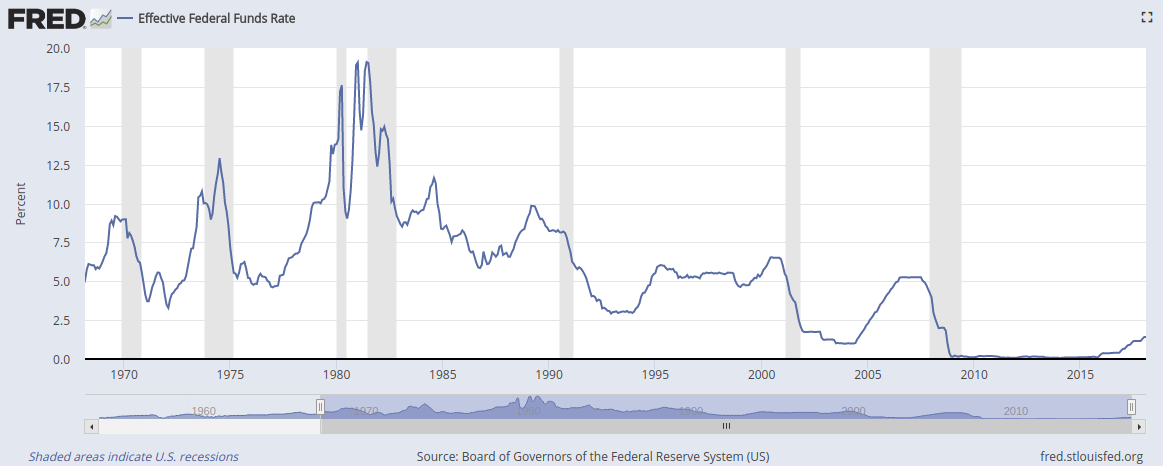

Fed stays the course

Fed stays the course