Consumption, savings and unemployment

Though we remain optimistic about the prospects for US growth over the longer-term, and continue to believe in the diversity and resiliency of the US economy, it is difficult to see much optimism in the short to medium term. Over the past few weeks, we’ve been delving into unemployment statistics at the state and local level to get a better sense of how bad this recession has been for employment.

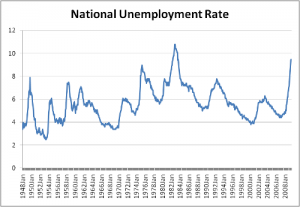

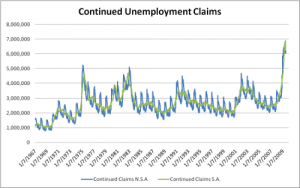

The national unemployment rate in June was 9.4%. With the exception of the recession of 1982-1983 (when it reached 10.8%), this is the worst unemployment rate in the post-second world war period. At a regional level, in nine states, the current unemployment rate is the highest since 1976 (the earliest year data is available at the BLS), and in another eight states (plus D.C.) it is within one percentage point of the record. Amongst those setting records, are two of the largest state economies CA and FL (also those worst affected by the real-estate boom, and a wide-swath of mid-atlantic states, MD, VA, GA, NC, SC. So in 18 of 50 states, joblessness is higher than most people have ever experienced. In absolute terms, more of the labor force is unemployed now (15.2 million) than at any time since 1948.

It is likely that unemployment will continue to rise until early 2010, and the unemployment rate could well exceed that of 1982-1983 and reach 11%. The primary reason for our pessimism about the speed and strength of a recovery is the shaky ground on which US households find themselves. Years of low and negative savings rates combined with falling asset prices have affected the biggest components of US household wealth, our homes and investments. The reverberations of this wealth effect will be felt for many quarters of US consumption and consumer confidence.

Unemployment affects consumer confidence in a way that GDP figures and corporate profits cannot. Continuing unemployment, seeing friends or neighbors out of work for months on end, makes consumers rethink every purchase.

Since we do not foresee a quick recovery in consumer demand, we believe a quick recovery in unemployment to the 5-6% level is unlikely. In prior recessions of similar severity, unemployment has not returned to the 6% range till 3-4 years have passed. This would suggest a return to full-employment in 2012 or 2013. It may take longer. We believe a structural adjustment is underway, with two sectors of the economy, construction and finance, shrinking to a semi-permanent lower level of activity. Former workers from these industries will need to retool themselves for work in other areas, or may need to relocate to another part of the country. This will take time.

The unwelcome triplet of rising unemployment, falling asset prices, and a financial crisis that has felled many firms that were household names will affect the American consumers’ view of thrift and spending for years to come. We believe the current recession’s affect on US consumer behavior will be long-lasting, as will the US investor’s new-found skepticism towards real-estate, debt and equities. This is similar to how a traumatic episode affects survivors. For an entire generation of Americans, this recession is their first encounter with generally difficult economic conditions and the realities of the business cycle. We believe there is a fundamental shift underway for a generation of Americans, away from a culture of high consumption, towards a new-found frugality.

The grasshoppers are chastened and the ants have been vindicated in particularly dramatic fashion.