A Long Road Ahead

There are decades where nothing happens; and there are weeks where decades happen

— V.I. Lenin

We hope you and your family are healthy and safe during this time.

The past quarter in the markets has been one of those periods where days can seem like years, and weeks like decades. We entered 2020 with risk assets, including stocks and high-yield bonds, trading at all time highs. Stocks reached lofty valuations on cyclically high earnings. An exceedingly overvalued market then ran into an exogenous shock that has prompted comparisons with the dust bowl of the 1930’s.

The S&P 500 started the year at 3230, and rose as high as 3393 in mid-February. Six weeks later, it ended the quarter in a bear market, down over 20% at 2584. This has been the quickest descent into a bear market for stocks in many decades. The moves in the bond market have been even more extreme. Early March was a period of immense dislocation in many major markets, precipitated by a collapse in oil as travel was curtailed across the globe. This created a spate of margin calls and the collapse of many levered trading strategies that rely on stable correlations between different asset classes. The margin calls and panic this induced drove numerous participants to raise cash, at any cost. The rush towards the safety of US treasuries pulled the 30 year yield below 1% in early March, a level never breached before. That was the earliest sign that something had begun to go very wrong. By late March, most market participants came to realize that without extended stay at home orders, the US healthcare system would be overwhelmed by the same issues confronting Northern Italy. Facing the possibility that death counts would rise exponentially as hospitals collapsed under the load of COVID-19 patients, most US governors made the responsible decision to curtail movements. We are now at the point where market participants are estimating the duration of these disruptions to normal economic activity.

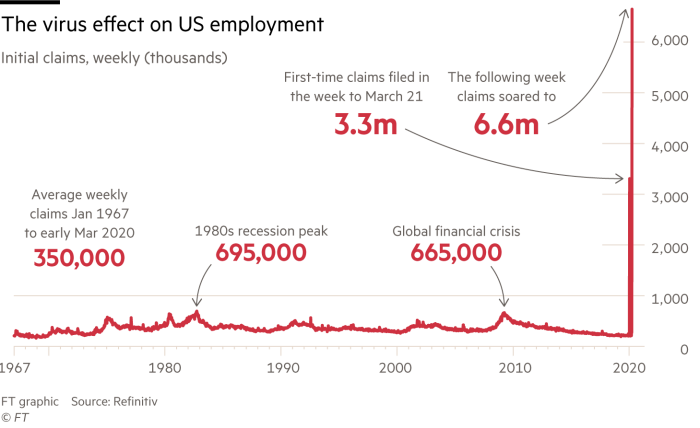

Our view remains the same as it was in early March. This is not a short-term pause, but rather the end of a business cycle. The size of the exogenous shock suggests to us that the damage will be extensive and could rival the 2008-2009 crisis. The speed with which job losses have occurred, essentially shuttering entire industries, has been shocking. US unemployment claims have never exceeded 900,000 in a single week. The week ending March 20 saw over 3.3 million workers file for unemployment. As if that number wasn’t staggering enough, it doubled the next week. 6.6 million additional workers filed for unemployment benefits during the week that ended March 27. Several large companies announced mass lay-offs or furloughs in the week ended April 3, so the news will likely continue to be grim. Every one of those lay-offs represents a family that now faces enormous uncertainty around basic material needs including shelter, food and healthcare. The human cost of our current situation is not limited to those who have fallen ill.

The US unemployment rate is almost certainly above 10% right now. Fed governors have speculated that in a worst case scenario, unemployment could climb as high as 30% or even 40%. These are numbers that the US has not seen since the Great Depression. While the US economy is very resilient, it’s hard to imagine a scenario, even with outsized levels of stimulus, where the economy bounces right back from a systemic shock of this magnitude.

The largest unknown in all our estimations is the actual trajectory of COVID-19. It is unclear how long the restrictive measures currently in place will be required. We do know that our government’s haphazard, tardy and contradictory response to the crisis in the early weeks closed off some of the less costly paths we could have followed. The US is now the clear epicenter of the pandemic and the developed economy most likely to shoulder the highest burden from it. The current conversation centers around “flattening the curve” of new infections, which have been rising steadily in the US (even in the absence of readily available, accurate tests). As the World Health Organization has pointed out, once the curve is flattened, it has to be brought down as well. The example of the Asian countries is that relaxing stay at home orders can easily lead to a resurgence in infections. Eradicating the pandemic is a task that will be measured in months, not weeks.

The machinery of the markets has been operating throughout the crisis, despite extreme volatility in both stock and bond markets. We have, however, seen the city we love come to a virtual standstill as every effort is made to contain the impact of the pandemic. It has been strange to see silence descend on New York during the daytime, a silence broken only by the tragic and constant wail of ambulances. Like many of you, our lives have been directly impacted by the pandemic. We have been unable to work from our office for weeks and have initiated our disaster recovery plans to work from home (we were prepared for this type of this situation despite how remote it may have seemed a few months ago). Unfortunately, the best information we have suggests that many other areas of the country might face similar circumstances soon.

In our view, the market’s recovery from this sudden stop will be slow and halting. In 2000-2002, it took the stock market over 18 months to bottom. In 2008-2009, it took a year and a half of declines before the nadir was reached. Though this crisis has arrived with remarkable speed, there is no reason to believe the recovery will be as sudden. The rolling, global nature of the shutdowns required to control the spread of the virus will ensure that some level of demand weakness remains through much of the year. Most economists now forecast a global recession that lasts three quarters with US GDP declines being estimated at 10-30% at their height.

We believe these numbers are in the right range, there is an outside chance that the extreme measures to mitigate the spread of coronavirus last longer. The impact on many industries and enterprises will be severe. A survey of small businesses in the US indicated that 25% of them anticipate closing permanently within weeks if conditions do not improve. Large businesses will face enormous financial stresses if revenue streams continue to be disrupted for months. We have already seen the impact in the high-yield bond pace, where many enterprises were operating at very high leverage with no margin for error.

Lastly, the scale of the fiscal and monetary stimulus required to stabilize the markets and the broader economy is immense. The US government has already passed a stimulus that will cost about 10% of GDP. We believe more will be required. The profligacy of the current administration meant we were operating trillion dollar deficits in the midst of an economic boom. With economic activity rapidly collapsing and the need for more stimulus measures apparent, the deficit will surely balloon to multiple trillions in 2020. It is clear that tax rates will have to rise in the future, and US government finances will be weaker. Among the long-range factors to consider is the reality that the US economy has now seen three extreme market crashes within the space of 20 years. This history will surely have an impact on the manner in which younger investors view the markets.

We continue to advise caution and recommend investors prepare for more swings in volatility as markets respond to data on the state of the economy, and search for a bottom over the coming months. For several quarters now, we have been increasingly defensive in our positioning (reducing stock exposure), concerned about outsized valuations. Though we believe the broad stock indices have not yet reached a bottom, we have begun to see decent valuations on some individual companies. The next few weeks will see a flood of Q1 corporate earnings reports and we’ll get more insight into how companies have managed this crisis and which are best positioned going forward.

The silver lining to major market downturns is that it provides a buying opportunity for investors who are patient and focused on the long term. By being defensively positioned, we’ll have the opportunity to shift money from low-risk bonds into stocks at more favorable valuations. While we think stocks likely have further to fall, calling a market bottom is difficult, so our strategy will be to buy incrementally when we see good value and think the risk/reward looks favorable.

Within every crisis are the seeds of adaptation that make us better able to avoid such crises in the future. Though the short and medium term prognosis is weak, in the long-term we expect to return to normal levels of growth. As with so many other challenges our society has faced, we are convinced we will make our way through this one as well.

Please contact us if you would like to discuss your portfolio or investment allocation, you may call +1.646.450.9772 or e-mail us (info@wsqcapital.com).

We hope you and your family are healthy and safe.

The past quarter in the markets has been one of those periods where days can seem like years, and weeks like decades. We entered 2020 with risk assets, including stocks and high-yield bonds, trading at all time highs. Stocks reached lofty valuations on cyclically high earnings. An exceedingly overvalued market then ran into an exogenous shock that has prompted comparisons with the dust bowl of the 1930’s.

The S&P 500 started the year at 3230, and rose as high as 3393 in mid-February. Six weeks later, it ended the quarter in a bear market, down over 20% at 2584. This has been the quickest descent into a bear market for stocks in many decades. The moves in the bond market have been equally extreme. Early March was a period of immense dislocation in many major markets, precipitated by a collapse in oil as travel was curtailed across the globe. This created a spate of margin calls and the collapse of many levered trading strategies that rely on stable correlations between different asset classes. The margin calls and panic this induced drove numerous participants to raise cash, at any cost. The rush towards the safety of US treasuries pulled the 30 year yield below 1% in early March, a level never before breached. That was the earliest sign that something had begun to go very wrong. By late March, most market participants came to realize that without extended stay at home orders, the US healthcare system would be overwhelmed by the same issues confronting Northern Italy. Facing the possibility that death counts would rise exponentially as hospitals drowned under the load of COVID-19 patients, most US governors made the responsible decision to curtail movements. We are now at the point where market participants are estimating the duration of these disruptions to normal economic activity.

Our view remains the same as it was in early March. This is not a short-term pause, but rather the end of a business cycle. The size of the exogenous shock suggests to us that the damage will be extensive and could rival the 2008-2009 crisis. The speed with which job losses have occurred, essentially shuttering entire industries, has been shocking. US unemployment claims have never exceeded 900,000 in a single week. The week ending March 20 saw over 3.3 million workers file for unemployment. As if that number wasn’t staggering enough, it doubled the next week. 6.6 million additional workers filed for unemployment benefits during the week that ended March 27. Several large companies announced mass lay-offs or furloughs in the week ended April 3, so the news will likely continue to be grim. Every one of those lay-offs represents a family that now faces enormous uncertainty around basic material needs including shelter, food and healthcare. The human cost of our current situation is not limited to those who have fallen ill.

The US unemployment rate is almost certainly well above 10% right now (in 2009, it peaked at 10%). Fed governors have speculated that in a worst case scenario unemployment could climb as high as 30% or even 40%. These are numbers that the US has not seen since the Great Depression. While the US economy is very resilient, it’s hard to imagine a scenario, even with outsized levels of stimulus, where the economy bounces right back from this magnitude of systemic shock.

The largest unknown in all our estimations is the actual trajectory of COVID-19. We have begun to see case numbers in parts of Europe and harder hit areas in the US level off, but it’s unclear how long the restrictive measures currently in place will be required. We do know that our government’s haphazard, tardy and contradictory response to the crisis in the early weeks closed off some of the less costly paths we could have followed. The US is now the clear epicenter of the pandemic and the developed economy most likely to shoulder the highest burden from it. The current conversation centers around “flattening the curve” of new infections, which have been rising steadily in the US (even in the absence of readily available, accurate tests). As the World Health Organization has pointed out, once the curve is flattened, it has to be brought down as well. The example of the Asian countries is that relaxing stay at home orders can easily lead to a resurgence in infections. Eradicating the pandemic is a task that will be measured in months, not weeks.

The machinery of the markets has been operating throughout the crisis, despite extreme volatility in both stock and bond markets. We have, however, seen the city we love come to a virtual standstill as every effort is made to contain the impact of the pandemic. It has been strange to see silence descend on New York during the daytime, a silence broken only by the tragic and constant wail of ambulances. Like many of you, our lives have been directly impacted by the pandemic. We have been unable to work from our office for weeks and have initiated our disaster recovery plans to work from home (we were prepared for this type of situation despite how remote it may have seemed a few months ago). Unfortunately, the best information we have suggests that many other areas of the country might face similar circumstances.

In our view, the market’s recovery from this sudden stop will be slow and halting. In 2000-2002, it took the stock market over 18 months to bottom. In 2008-2009, it took a year and a half of declines before the nadir was reached. Though this crisis has arrived with remarkable speed, there is no reason to believe the recovery will be as sudden. The rolling, global nature of the shutdowns required to control the spread of the virus will ensure that some level of demand weakness remains through much of the year. Most economists now forecast a global recession that lasts three quarters with US GDP declines being estimated at 10-30% at their height.

We believe these numbers are in the right range, though there is an outside chance that the extreme measures to mitigate the spread of coronavirus last longer. The impact on many industries and enterprises will be severe. A survey of small businesses in the US indicated that 25% of them anticipate closing permanently within weeks if conditions do not improve. Large businesses will face enormous financial stresses if revenue streams continue to be disrupted for months. We have already seen the impact in the high-yield bond space, where many enterprises were operating at very high leverage with no margin for error.

Lastly, the scale of the fiscal and monetary stimulus required to stabilize the markets and the broader economy is immense. The US government has already passed a stimulus that will cost about 10% of GDP. We believe more will be required. The profligacy of the current administration meant we were operating trillion dollar deficits in the midst of an economic boom. With economic activity rapidly collapsing and the need for more stimulus measures apparent, the deficit will surely balloon to multiple trillions in 2020. It is clear that tax rates will have to rise in the future, and US government finances will be weaker. Among the long-range factors to consider is the reality that the US economy has now seen three extreme market crashes within the space of 20 years. This history will surely have an impact on the manner in which younger investors view the markets.

We continue to advise caution and recommend investors prepare for more big swings in volatility as markets respond to news flow and search for stability over the coming months. For several quarters now, we have been increasingly defensive in our positioning (reducing stock exposure), concerned about outsized valuations. Though we believe the broad stock indices have not yet reached a bottom, we have begun to see decent valuations on some individual companies and some good opportunities in the bond space. The next few weeks will see a flood of Q1 corporate earnings reports and we’ll get more insight into how companies have managed this crisis and which are best positioned going forward.

The silver lining to major market downturns is that it provides a buying opportunity for investors who are patient and focused on the long term. By being defensively positioned, we’ll have the opportunity to shift money from low-risk bonds into stocks at more favorable valuations. While we think stocks likely have further to fall, calling a market bottom is difficult, so our strategy will be to buy incrementally when we see good value and think the risk/reward looks favorable.

Within every crisis are the seeds of adaptation that make us better able to avoid such crises in the future. Though the short and medium term prognosis is weak, in the long-term we expect to return to normal levels of growth. As with so many other challenges our society has faced, we are convinced we will make our way through this one as well.

Please contact us if you would like to discuss your portfolio or investment allocation

Regards,

Subir Grewal, CFA, CFP Louis Berger