2012 Q3 Letter: Quantitative Easing – To Infinity and Beyond!

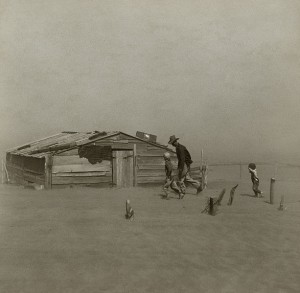

We hope all of you in the north-east made it through Hurricane Sandy safe and sound. For many of us, it was a reminder of the awesome power of mother nature, the interconnectedness of our modern lives and the fragility of our beautiful planet. US stock markets were closed for two days straight, and our offices in lower Manhattan will be without power till the weekend. We have been working remotely, and it has been a good test of our disaster readiness procedures.

The big economic news of the third quarter was the Federal Reserve’s decision to take the unprecedented step of intervening in the capital markets during the home stretch of a presidential election campaign. We’ve noted in previous letters that as a non-partisan institution, the Federal Reserve prefers to avoid any appearance of political favoritism, often going to great lengths to maintain this reputation. By intervening in the capital markets at the height of election season, the Fed risks the appearance of favoritism towards the incumbent party. Expansionary monetary intervention can drive stock market rallies and boosts investor confidence, benefiting the party in power – in this case, the Obama administration. Using this logic, our thinking was the Fed would abstain from announcing any new stimulus plans until after the election. It turns out we were wrong.

On Thursday September 13th, by a vote of 11-1, the Federal Reserve board voted to launch QE3, their latest and greatest stimulus plan effort. Unlike past plans, this one is unique in that it is open-ended, there isn’t a set expiration date or monetary cap. And instead of purchasing US Treasuries, which the Fed has done in the past, QE3 involves a $40 billion monthly purchase program of agency mortgage-backed securities. In addition to QE3, the Fed also announced that it expects to keep interest rates close to 0% through the end of 2015 (having previously stated that rates would remain at this level through 2014).

These policy announcements come on the heels of the Fed’s June 20th decision to extend Operation Twist through the end of 2012 and the European Central Bank’s Sept 6th decision to initiate their own open-ended “no limit” bond buying program to purchase European sovereign debt as and when needed. Four years after Lehman Brothers’ failure, the Fed and ECB continue to reload their monetary “bazookas”.

So why is the Fed stepping in now with such a bold plan given the upcoming election and their recent action in June? Well, with a muddled employment picture and a relatively stagnant housing market, the Fed sees monetary stimulus as a necessary crutch to keep the economic recovery moving forward, especially since the current Congress has no interest in passing any further economic stimulus. By purchasing these bonds, the Fed hopes to lower rates and encourage companies to borrow and expand operations (hire more people), and nudge individuals to buy large ticket items (spend more money) and take on mortgages (buy homes).

Sounds good, right? What could be wrong with encouraging corporate hiring and consumer spending? Well, several things, actually:

- Inflation: If the economy recovers sooner than expected, food, materials and energy costs may rise much faster than the economy.

- Weak dollar: A weaker currency makes imports more expensive and can drive inflation further. The flip side of this is that a weaker dollar makes US exports more competitive.

- Encourages speculation: Low interest rates imply cheap credit, so speculative investors – the kind whose actions led to the credit crisis — can afford to take on more risk through leverage and loans. And as high-risk assets outperform, these speculators are financially rewarded.

- Punishes savers: Conservative investors – the ones who were fiscally responsible during the housing mess – are punished. These investors (often retirees) who normally keep their money parked in savings accounts, short term CDs or Treasuries are being forced into riskier asset classes because interest rates are so paltry. More money heading into riskier or longer-dated bonds drives those rates even lower, so savers have to be even more aggressive than ever to generate decent returns.

- Using all their bullets: Now that the Fed has given the market what it wants – a virtually unlimited supply of stimulus, QE to infinity – how will they ever top this? If things turn south in the global economy, what can the Fed do to calm nervous investors?

- Sets the housing market up for a fall: Real-Estate prices are extremely sensitive to interest rates since most buyers borrow some portion of the purchase price of their home. Higher interest rates lead to higher monthly payments, which in turn drives home prices down. At the moment, low rates are propping up home prices, when they begin to rise, this support will disappear and home prices may well stagnate or fall.

We also see the election and the forthcoming budgetary debate having an impact on municipal bonds and US state finances. Over the next few months, one of the major ratings agencies will revise the way it accounts for the long-term pension liabilities incurred by municipalities. Many state budgets and finances are still in a weak state after the crisis, and this revision may lead to some ratings downgrades. In addition, we expect the US federal deficit to take center stage after the election. Regardless of which party controls congress or the presidency, we expect to see federal support to states weaken further. This means states will have to fend for themselves, implying weaker municipal credits, absent a very strong recovery.

So how should investors respond to these new policies? We prefer a conservative balanced portfolio of stocks and bonds for most investors. We are reluctant holders of interest-rate sensitive or cyclical stocks and longer-term bonds, recognizing that the Fed’s policies are driving prices up in those sectors. We retain a preference for high quality, dividend-paying stocks and utilities. In the bond market we continue to limit holdings to high-quality corporate, municipal and international emerging market debt, keeping maturities short. We realize this is not a recipe for outsized returns, but we would rather be safe than sorry.

As we approach the holiday season, we recommend all clients consider the following year-end planning items:

- Review your 401K contributions (you have until Dec 31 to use the 2012 limits), and IRA contributions.

- Consider re-allocating between securities as the Bush tax cuts sunset and capital gains rates may go up.

- For those with taxable estates, it is worth reviewing the special gifting opportunities available in 2012.

As most of these items involve tax-planning, and since we do not provide tax-advice, we do recommend consulting you tax professional prior to taking any action. We are, as always, happy to assist.